Our client was using a prototype cash-flow management tool developed on Excel. While this automated some of the manual work the tool had become increasingly difficult to extend for additional forecasts and functionality.

With a dynamic team, and essential input from the client, VerifAction developed a robust and flexible system allowing full cash-flow management for all funds. This new system:

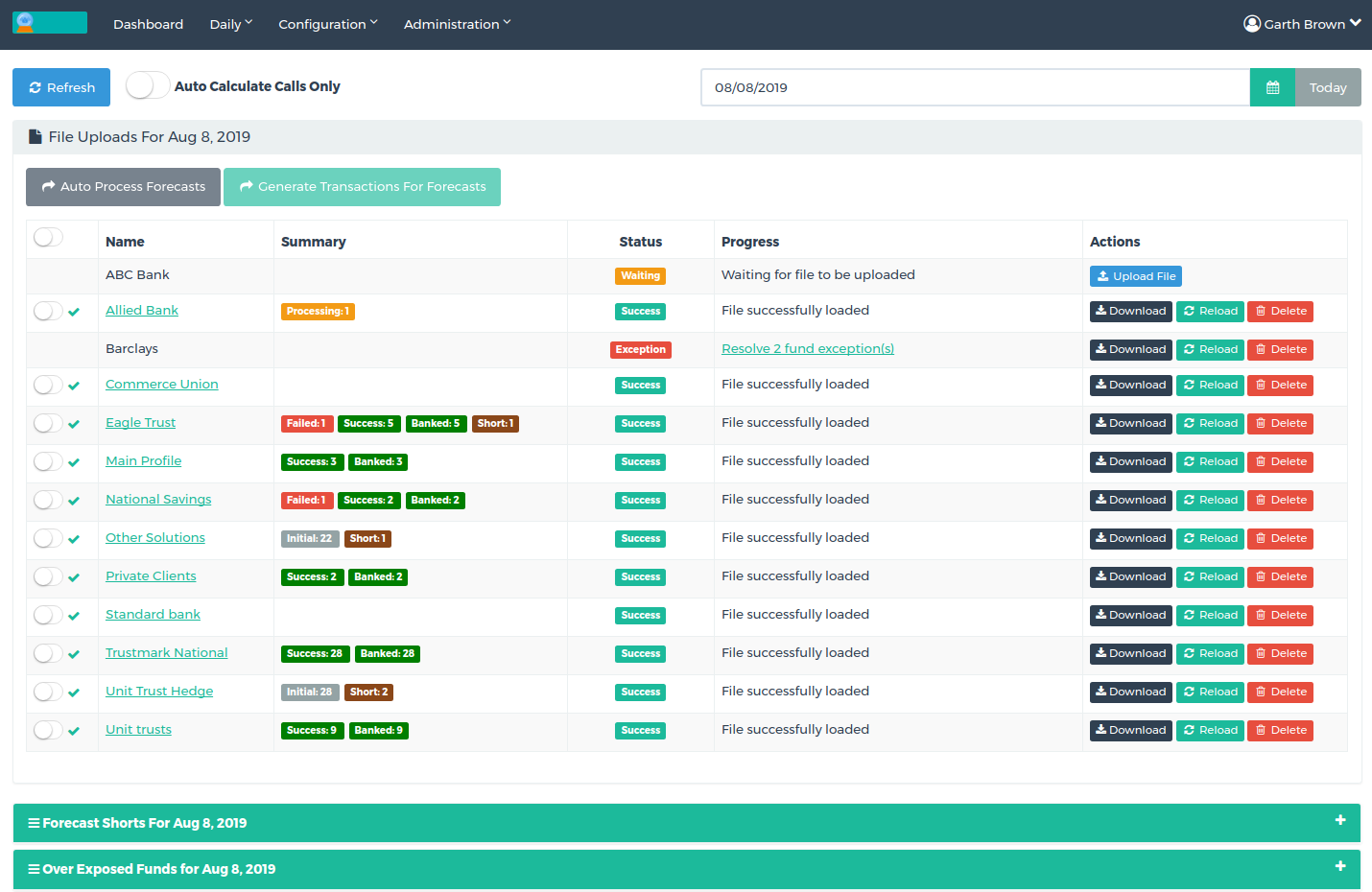

- Imports daily forecasts,

- Monitors for new funds,

- Handles exceptions according to rule-sets and

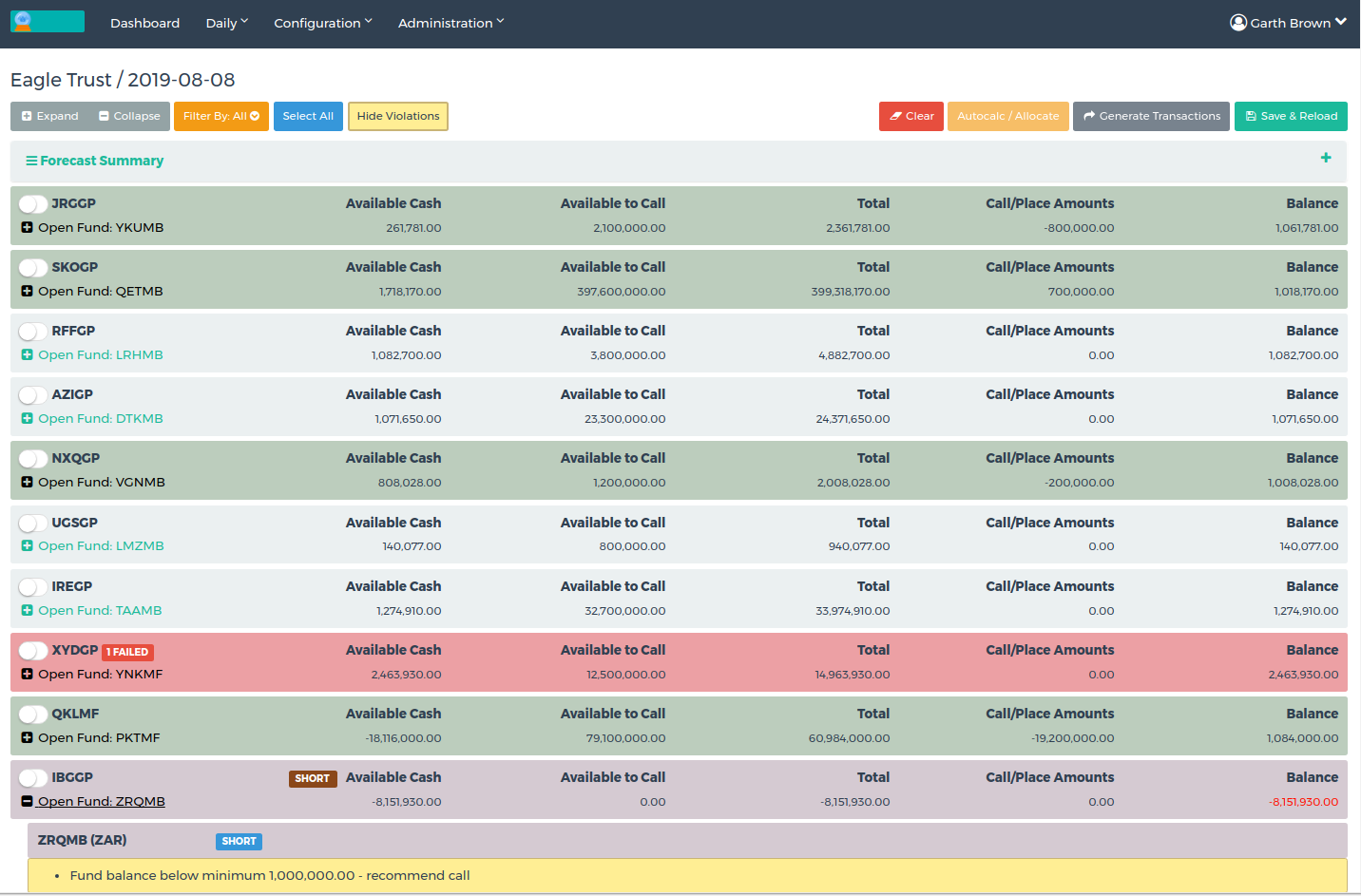

- Swiftly generates an optimal cash flow strategy for each day.

- Account balances

- Fund forecasts

- Manual adjustments

- Market values for calculating issuer exposure

- Maturity reports

- Fund group limits and balances

- Issuer exposure

- Call account rates

- Overall bank limits

- Fund minimum and maximum limits

- Special rules for funds